By Felix Maile and Cornelia Staritz

There has been much talk about the reconfiguration of global supply chains in recent years. Intensified geopolitical tensions, the climate crisis, digitalization and supply chain disruptions have fuelled debates about a potential restructuring of the global economy, with terms such as ‘nearshoring’ or ‘friendshoring’ circulating widely across journalistic, academic and policy circles. To make sense of these portrayed shifts, the Research Network Sustainable Global Supply Chains – an interdisciplinary group of more than 70 international scholars that work on global supply chains – recently published its 2023 Annual Report. The report explores the reconfiguration of global supply chains across energy, mineral, food, and manufacturing sectors, and covers a wide range of debates and views on re-, near- and friendshoring, local value addition, and the merits and risks of industrial policies.

As one contribution to the report, we analyze key shifts in global apparel supply chains: Since the outbreak of the Covid-19 pandemic, the global apparel industry has been subject to intense market volatility. Massive numbers of order cancellations and related losses in supplier countries were followed by a rapid recovery in orders, only to be succeeded by supply overstock and declines in demand. At the same time, key transformations that were already underway have been intensified: First, as e-commerce boomed during the pandemic, fashion brands and retailers are expanding their online distribution channels to increase sales and reduce inventory. Second, new regulations to curb the industry’s notoriously high emission and pollution levels led to lead firm initiatives around energy-efficiency, renewable energy, and less carbon-intensive materials. Third, as geopolitical tensions between the US and China mounted, lead firms intensified ‘de-risking’ from China and ‘China+1’ sourcing strategies. As a result of these shifts, some industry participants argue that manufacturing activities will move closer to the two large consumer markets of the EU and the US, which is commonly termed as ‘nearshoring’. In that context, our article assesses the extent to which these shifts are materializing, the factors that drive them, and whether they will culminate in shorter apparel supply chains.

Reducing excess inventory through online sales?

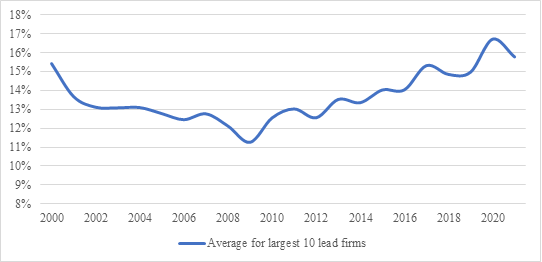

An increasing number of lead firms aims to scale their e-commerce presence, which is mainly driven by an attempt to reduce high inventories. The main distribution channel for fashion brands and retailers remains physical outlets. But as these stores provide limited options to generate consumer data and anticipate demand, many lead firms end up with high mark downs, unsold goods and high inventory costs. Figure 1 shows that for the largest 10 apparel lead firms, inventory costs have steadily increased since the financial crisis of 2008.

Figure 1: Share of inventory costs on revenue (%), top 10 apparel lead firms, 2000-2021

Source: Capital IQ database. The largest apparel lead firms by revenue include TJX, Nike, Inditex, Adidas, Shein, H&M, Fast Retailing, VF, PVH, GAP.

In contrast, online retailers such as the UK-based ultra-fast fashion firms Asos and Bohoo, or Chinese-owned Shein, are able to access and analyze large amounts of consumer data to avoid forecasting errors. Based on data generated on social media platforms and their sales websites, online retailers deploy a ‘test and react’ model, in which a variety of micro collections are brought to market within less than two weeks. Those orders that perform best are then produced at a larger scale, which allows to minimize forecasting errors and therefore reduce unsold goods and inventory costs.

Major apparel lead firms such as Zara or H&M want to emulate this strategy and have intensified their investments in online distribution networks, websites and data analysis. Deploying a ‘test and react’ model requires supply chains that build on small batch production, textile verticality and pronounced multi-tiered sourcing structures, which include ‘onshore’ distribution and assembly facilities located within or ‘nearshored’ facilities located in direct proximity to end markets, in addition to offshore facilities. Instead of a fundamental relocation of supply chains, the related geographical changes are likely to occur as gradual shifts. Even for e-commerce retailers such as Asos, the majority of suppliers remains located in ‘offshore facilities’ in China, Vietnam and India. Further, fast fashion lead firms rely already to a certain degree on multi-tiered sourcing structures, and while the majority of lead firms aims to increase online sales, this is not yet the case for all brands and retailers.

Sustainability as the new norm?

The apparel industry accounts for 8 to 10% of global emissions, represents 20% of global industrial water pollution, and contributes to high levels of landfill as well as oceanic microplastic pollution. In that context, policymakers in major end markets have introduced a set of regulations that aim to curb the industry’s environmental footprint.

Mandatory corporate sustainability reporting across Europe, the US and Japan now require lead firms to report the emissions of their own operations, but also those of their supply chains, where the bulk of emissions accrues. Further, several European countries have introduced mandatory supply chain due diligence laws that require to conduct environmental risk assessments and due diligence. As the most ambitious regulation, the EU Strategy for Sustainable and Circular Textiles contains a package of 16 regulations, including minimum requirements on recyclability of apparel goods and recycled content.

As a response, large apparel lead firms have announced to reduce the emission levels in their supply chains in the next years. It has been argued that this also requires nearshoring to cut shipping emissions, which however only account for 3% of the industry’s emissions. Instead, lead firms increasingly require from their supplier firms and supplier country governments to make investments into renewable energy supply, energy efficiency programs and waste management, as it is the case in Bangladesh, Vietnam or Ethiopia. Another response by some lead firms has been to invest into start-ups that work on new recycling technologies and fibers from bio-based feedstocks. At the moment, these firms are predominately based in the US and in Europe, so that we could see a geographical shift in the segment of sustainable textiles. But this remains to be seen, as the share of sustainable textiles thus far remains relatively small, and suppliers from the Global South could also enter that segment.

De-risking from China?

The ‘China+1’ sourcing strategy has been already underway since the early 2010s, when labor costs in China began to rise. This is reflected in China’s declining share in global apparel exports, which peaked at 43% in 2010 and dropped to 31% in 2019. In recent years, this trend was further reinforced by two key policy shifts. The US-China trade war placed tariffs of up to 7,5% on US imports of textile and apparel products from China, and the introduction of the Uyghur Forced Labor Prevention Act (UFLPA) places a ban on US-imports of goods, including cotton, that contain components made by firms that operate in the Xinjiang region.

As a result, apparel brands and retailers seek to further diversify their supply chains away from China, and particularly the Xinjiang region. These shifts take place however largely within Asia, with key winners being Vietnam and Bangladesh. At the same time, a full ‘decoupling’ of apparel supply chains is highly unlikely, given the ongoing reliance of lead firms particularly on fabrics supply from China, as well as ancillary components such as trims, buttons, and zippers. Further, the Chinese consumer market has been the main growth engine for many lead firms such as H&M, Nike or Adidas. They therefore aim at complying with US and EU regulations while at the same time trying to avoid confrontation with the Chinese government that could easily cut them off from (online) market access.

Supply chains become shorter, but within existing multi-tiered sourcing structures

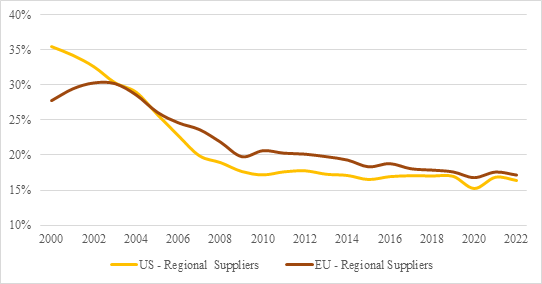

A number of industry surveys suggested that these ongoing transformations will result in geographical restructuring of apparel supply chains. For example, in a recent survey, more than half of 400 sourcing executives that were interviewed expected that nearshoring will increase in 2024. A quick materialization of these proclaimed nearshoring strategies is however not yet visible in trade statistics, as the share of regional suppliers, which experienced a secular decline in the 2000s, has remained stagnant in the 2010s and early 2020s. As Figure 2 illustrates, regional supplier accounted for 16% in the US, and 17% in the EU in 2022.

Figure 2: Share of apparel imports from regional suppliers (%), 2000-2022

Source: UN Comtrade. Note: EU regional suppliers include CEE20, MENA4 and Turkey; US regional suppliers include Mexico, Central America, South America and the Caribbean.

But trade date is slow to pick up geographical relocations, given the time lag between nearshoring investments and actual start of production as well as delays in the reporting and publishing of trade data. Therefore, we conducted a systematic media analysis of the two main apparel industry journals (Just Style Magazine, Sourcing Journal) that captures the time frame between the start of the pandemic, when discussions on nearshoring began to spark, and July 2023. The data suggests that there are a number of investments in onshoring and nearshoring facilities in apparel assembly, but also importantly in the ‘verticality’ of textile and apparel production, aiming to increase the local or regional supply of textiles inputs in established apparel assembly locations.

Overall, there were announcements on 21 nearshoring investments, 6 onshoring investments and 28 investments into textile verticality. The combination of verticality with scaling up nearshored assembly production was particularly pronounced in Central American countries and in Mexico. This is also related to the US government’s ‘strategy for addressing the root causes of migration in Central America’ which includes a ‘Partnership for Central America’ that incentivises textile and apparel investments.

Table 1: Announced investments in verticality, nearshoring and onshoring (3/2020-7/2023)

| Country | Verticality | Nearshoring | Onshoring |

| Mexico | 4 | 5 | |

| Haiti | 1 | ||

| Guatemala | 3 | 3 | |

| Dominican Republic | 1 | ||

| Costa Rica | 1 | 1 | |

| El Salvador | 2 | 3 | |

| Honduras | 5 | 3 | |

| Brazil | 1 | ||

| US | 7 | 5 | |

| Sri Lanka | 1 | ||

| Bangladesh | 1 | ||

| Vietnam | 2 | ||

| India | 1 | ||

| Italy | 1 | ||

| Jordan | 1 | ||

| Egypt | 2 | 3 | |

| Turkey | 1 |

Sources: Based one key word search for ‘verticality’, ‘nearshoring’ and ‘onshoring’ in Just Style Magazine and Sourcing Journal; March 1 2020 to July 31 2023.

In light of the discussed transformations, it can be expected that the geographies of the apparel industry will change gradually towards more nearshoring and textile verticality, but within multi-tiered structures and with offshore production in Asia remaining dominant. Nearshoring has been selective – it is currently focused on Central America, Mexico and potentially Turkey – and reshoring back to the US or Europe has so far been limited to the area of small batch assembly and, more importantly, the new emerging recycling textile segment.

Although de-risking from China will provide opportunities for other supplier countries, the increased requirements of buyers (CO2 emission reductions, renewable energy, shorter lead times, higher production flexibility, multi-country production facilities, verticality, recycling) raise the entry barriers for supplier firms. It is therefore likely that larger transnational first-tier supplier firms are better positioned to fulfill these requirements, which can be expected to lead to further consolidation among supplier firms.

Read more in our article in the 2023 Annual Report of the Research Network Sustainable Global Supply Chains.

Felix Maile is a PhD Researcher at the Department of Development Studies at the University of Vienna. His PhD investigates the role of financial markets and shareholder value on the sourcing strategies of apparel retailers and brands, the related power dynamics along the apparel GVC, and what this means for value capture in supplier countries.

Cornelia Staritz is Associate Professor in Development Economics at the Department of Development Studies at the University of Vienna and Research Associate at the Austrian Foundation for Development Research (ÖFSE) and at Policy Research on International Services and Manufacturing (PRISM) at the University of Cape Town. Her research focuses on development economics and policy, international trade and trade policy, global production networks and value chains, and commodity-based development.